Current portfolio

-

DNS:NET

GermanyCommunications

Digitalisation

Overview

DNS:NET is a leading independent telecommunications provider in Germany. Established in 1998, DNS:NET owns the largest independent fibre-to-the-cabinet network in the Berlin area and is rolling out a fibre-to-the home network in Berlin and the surrounding regions.

The company differentiates itself through a superior network, local brand recognition and attractive pricing of high bandwidth products, which drives high customer satisfaction. 3i Infrastructure’s backing will allow DNS:NET to accelerate its build programme to provide gigabit-ready connectivity to its customers.

Recent Developments

In line with our business plan, in December 2022, 3iN invested a further €18 million into DNS:NET in support of its continued FTTH roll-out. DNS:NET, like many players across the sector, has experienced delays in connecting and activating waiting customers on its network. It has also experienced delays in the handover of local authority constructed networks that it will then operate. We have updated our forecasts to reflect these delays.

In January 2023, Andre Mueller was appointed as CFO. He brings a wealth of experience as a senior finance professional across a range of sectors. Work has also been undertaken during the year to further strengthen the management team, with further recruitment expected to be announced in the summer.

Note: FTTH: Fibre-to-the-home.

Investment rationale

In June 2021, 3i Infrastructure plc invested c.€182m to acquire a 60% stake in DNS:NET.

Fibre is superior to other broadband access technologies because it provides reliable low latency, high bandwidth and distance-independent connectivity for both download and upload. Demand for FTTH connectivity is forecast to grow rapidly, as consumers normalise data intensive activities such as cloud-based remote working, high definition streaming and online gaming, and increasingly view high speed broadband as an essential service.

Germany lags behind most European countries in its FTTH deployment, with only 14% coverage today compared to the European average of 33%. The market is projected to grow at 30% p.a. to meet the German government’s objective of every one of its 43 million households having access to gigabit speed broadband by 2025.

Sustainability

DNS:NET is currently investing in fibre-to-the-home (FTTH) infrastructure in the East of Germany: in Berlin vicinity; Brandenburg and Saxony Anhalt. This will provide high speed connectivity for homes in the region and in turn will support local economic growth. From an environmental standpoint, DNS:NET’s fibre network has a very low GHG footprint once deployed. Fibre is a greener alternative to copper cables, requiring significantly less energy and fewer maintenance and repair interventions. Reliable high-speed connectivity also facilitates an increase in virtual meetings and WFH, reducing emissions related to business travel and commuting. It is also key for new digital use cases, such as demand side management or smart building energy management systems, which will further drive energy efficiency and carbon reduction.

Key factsLargest independent fibre-to-the-cabinet (FTTC) network in Berlin>380 employees3 data centres in Berlin -

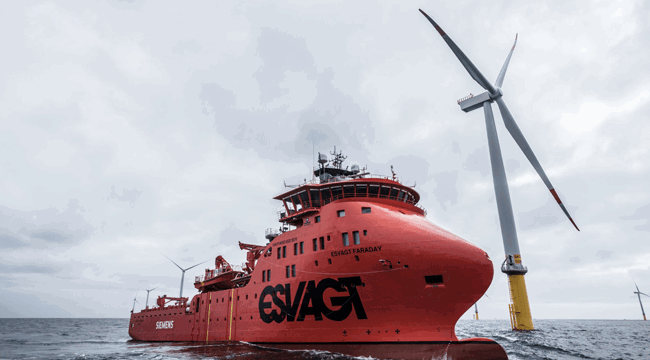

ESVAGT

DenmarkEnergy

Energy transition

Overview

Headquartered in Esbjerg, Denmark, ESVAGT is a leading provider of emergency rescue and response vessels (“ERRV”) and related services to the offshore energy industry in and around the North Sea and the Barents Sea. The company is also the market leader in the fast growing segment of service operation vessels (“SOV”) for the offshore wind industry.

Its ERRV services mainly involve the rescue and recovery of personnel, but also include the dispersion and recovery of oil spills, crew transfers and towing. ESVAGT is the leading provider of ERRV services in Denmark and Norway, with market shares of approximately 100% and 50%, respectively, as well as an established and growing presence in the UK. The majority of ESVAGT’s ERRV revenues are associated with North Sea oil and gas production support, with the remainder generated by supporting exploration activity.

ESVAGT is also the pioneer and market leader in the provision of SOVs to offshore wind farms, with seven bespoke vessels in operation and a further two under construction. SOVs are purpose-built, high performance vessels, providing efficient transport of maintenance technicians to wind turbines and other offshore wind equipment, under long term contracts. The offshore wind market, and hence demand for SOVs, is expected to grow strongly over the coming years, creating significant opportunities for the company.

ESVAGT has been operating since 1981, employs over 1,000 people and owns a fleet of more than 43 vessels.

Recent developments

ESVAGT has established a leading position in the offshore wind service operation vessels (‘SOV’) market. Its US joint venture, CREST, signed its first contract, a 15-year availability-based agreement with Siemens Gamesa servicing the Coastal Virginia Offshore Windfarm. This win positions ESVAGT very well as the near-term pipeline grows in the region. In Europe, a number of tenders will take place over the next 12 months and ESVAGT is expecting to benefit from its recent win of the first green SOV for Ørsted in 2022.

The EERV segment continues to see strong momentum due to the improved oil and gas markets, attractive supply / demand dynamics and an increased focus on security of supply in Europe due to the war in Ukraine. ESVAGT has benefited from these attractive market conditions to extend several key contracts.

Inflation is generally positive for ESVAGT due to its index-linked contracts, however cost inflation, in particular fuel costs, has accelerated faster than expected in the period

Investment rationale

3i Infrastructure acquired ESVAGT from AP Møller-Maersk and other minority shareholders in September 2015, in a consortium with AMP Capital.

ESVAGT has strong infrastructure characteristics and operates in an attractive market:

- It is a market leader in Denmark and Norway and has a small but growing presence in the UK offshore oil and gas market and in the expanding North Sea offshore wind sector.

- It is an asset intensive business, with a modern state-of-the-art fleet of purpose-built vessels.

- A high proportion of its revenues is contracted over the medium term with a diverse customer base featuring limited customer concentration, underpinning stable and predictable cash flows.

- It provides an essential service for the offshore energy industry in light of regulatory health and safety requirements, which constitutes a small component of the overall production cost, resulting in lower price sensitivity;

- It operates in a market with high barriers to entry, as customers require bespoke vessels, manned by experienced crews with a strong safety track record. The harsh weather conditions and language barriers also inhibit new market entrants based outside the region; and

- With its leading market position, strong safety track record and state-of-the-art fleet, ESVAGT is optimally positioned to exploit growth opportunities in the UK and potentially further afield, as well as in the offshore wind energy market.

Sustainability

Sustainability is at the core of ESVAGT's strategy. As the market leader and largest operator of Service Operation Vessels (SOVs) in Europe, the business supports the development of the offshore wind sector. It also supports its customers to reduce emissions in their supply chains, notably through innovative energy efficient vessel design and work on low emission fuels such as battery, bio and e-fuel. Additionally, making the sea a safe place to work has been ESVAGT’s mission from day one. The business has a strong track record of health and safety supported by a comprehensive programme of initiatives for employees and customers. In 2022 the business experienced zero lost time incidents – a significant achievement.

-

Future Biogas

UKUtilities

Energy transition

Overview

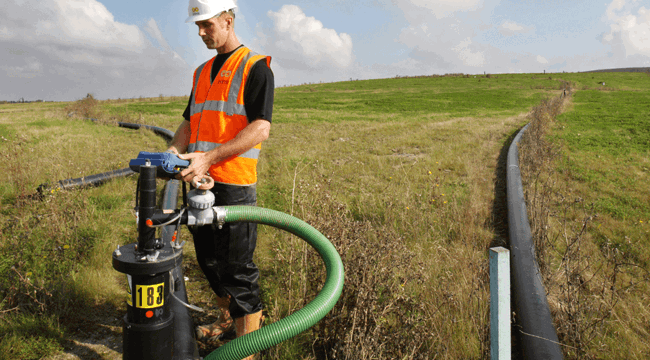

Future Biogas is one of the largest anaerobic digestion (AD) plant developers and biogas producers in the UK, operating 11 AD plants on behalf of institutional investors under long-term contracts.

Future Biogas’s plants convert a wide range of feedstocks into clean and renewable energy through AD which produces biogas. Biogas can either be used to generate green electricity, or upgraded into biomethane and injected into the UK’s national gas network. Future Biogas produces over 500GWh of biogas per year, enough energy for over 40,000 homes.

Biomethane from AD is a ready-to-use and commercially-viable solution for hard to decarbonise industrial sectors. It does not require any upgrade to the existing UK gas infrastructure. Energy produced by AD plants is carbon neutral, as the CO2 released during the process matches the CO2 absorbed from the atmosphere by the feedstock.

Future Biogas promotes a regenerative farming approach, sustainably integrating feedstock from energy crops into agricultural systems. The circular process of returning digestate back to land can help replenish soil nutrients and carbon and displaces demand for carbon intensive artificial fertilisers.

Investment rationale

- Future Biogas is the largest producer of biomethane in the nascent UK market and a highly experienced developer and operator of AD plants, with full-service capabilities in development, construction and operations.

- There is strong political support and growing corporate demand for domestically-produced biomethane, which, as a direct substitute for fossil natural gas, has an essential role to play in decarbonising some of the UK’s gas dependent sectors such as heat, transport and manufacturing.

- On a national scale, the use of biomethane (vs. natural gas) allows the existing gas infrastructure to help meet the UK Government’s Net Zero and energy security targets without any change to the existing system.

- Future Biogas will develop a new generation of unsubsidised AD plants and sell the resulting biomethane under long-term offtake agreements to corporate buyers.

- In the longer term, Future Biogas intends to enter the nascent but high potential voluntary carbon offset market through carbon capture and storage.

- Future Biogas has a highly experienced management team with a strong track record in the sector.

Sustainability

Future Biogas fundamentally supports the Energy Transition and the move away from natural gas, as biomethane from AD is a ready-to-use and commercially viable solution for hard to decarbonise industrial sectors. Energy produced by AD plants is carbon neutral, as the CO2 released during the process matches the CO2 absorbed from the atmosphere by the feedstock. In the future, carbon capture and storage could be introduced to make the process carbon negative.

Additionally the business supports the transition towards more sustainable farming practices. By promoting a regenerative farming approach, feedstock from energy crops can be sustainably integrated into agricultural systems. The circular process of returning digestate back to land can help replenish soil nutrients and carbon and displaces demand for carbon intensive artificial fertilisers.

Key factsLargest producer of biomethane in the UK11 anaerobic digestion plants+500GWh of biogas produced per yearPromotes sustainable farming practices -

Global Cloud Xchange

UKCommunications

Digitalisation

Overview

Global Cloud Xchange (“GCX”) is a leading global data communications service provider and owner of one of the world’s largest private subsea fibre optic networks. The business provides high-bandwidth connectivity to a range of customers including over-the-top content providers, telecom carriers, new media providers and enterprises.

GCX’s 66,000km of cables span from North America to Asia. It is particularly strong on the Europe-Asia and Intra-Asia routes where it is well positioned to capitalise on growth opportunities and serve the exponentially growing demand for data traffic.

Recent developments

Since our acquisition, the business is performing in line with expectations; lease revenues have grown strongly as the business prioritises recurring revenues over one-off cash IRU sales.

GCX is currently examining several opportunities to invest in new cables in the Middle East which would provide synergies with its existing network.

Investment rationale

In November 2021, 3i Infrastructure plc agreed to invest c.$512m to acquire a 100% stake in GCX. Additional acquisition debt was raised in March 2022, reducing the Company's equity commitment to $377m. The investment completed in September 2022.

- GCX owns one of the most comprehensive subsea cable networks globally, serving customers in over 180+ countries

- Benefits from the rapidly expanding data market with data usage forecast to grow exponentially

- Operates in a market with high barriers to entry whilst providing an essential service

- Supported by a highly experienced management team who have a strong track record in the sector

Sustainability

As a leading global data communications service provider and owner of one of the world’s largest private subsea fibre optic networks, GCX enables increased connectivity to underserved regions in Asia, Africa and Middle East. The business is continuously developing solutions to maximize the efficiency, utilisation and capacity of existing assets and systems, reducing environmental impacts. GCX is actively developing an ESG strategy to enhance its environmental, social and corporate governance. In addition, the business is in the process of certifying its carbon footprint and working on emission reduction initiatives.

Key facts>180 countries Customers in over 180 countries>46 countries Access to landing stations in over 46 countries66,000km Cables spanning 66,000km from North America to Asia -

Infinis

UKUtilities

Energy transition

Overview

Infinis is the largest generator of electricity from landfill gas (“LFG”) in the UK, with a portfolio of more than 150 operational sites and total installed capacity of over 400MW.

Alkane Energy acquisition

In March 2018, the Company announced its intention to increase its investment in Infinis by £125 million to fund Infinis’s acquisition of Alkane Energy (‘Alkane’), an independent power generator from both coal mine methane (‘CMM’) and reserve power (‘Peaking’) operations and the largest generator of electricity from CMM in the UK.

Recent developments

Financial performance at Infinis was strong in the year, driven by higher power prices and price volatility which benefitted the power response assets in particular. Infinis’s cashflows are positively correlated with UK inflation through index-linked corporate PPAs and the Government-backed Renewables Obligations Certificate and CfD regimes.

Infinis has made significant progress establishing a 1.5GW solar and battery pipeline across various stages of development. 103MW of Solar and 16 MW of Battery are currently under construction and on schedule to start generating by summer 2023, which will bring Infinis’s operational asset base to over 550MW. Higher development capex has been offset by a corresponding increase in long-term forecast power prices.

Investment rationale

The investment in Infinis is foremost a yield play. Its front-ended cashflows balance other recent investments by the Company in more growth-oriented businesses. Revenues are underpinned by the inflation-linked UK Renewables Obligation Certificate (“ROC”) regime until 2027. Infinis could also become a platform to make new investments in activities such as distributed power generation from other gas sources, distributed energy storage by exploiting the business’s spare engine and grid connection capacity, and additional landfill gas sites.

Infinis and its market

Infinis is the largest generator of electricity from LFG in the UK, with a portfolio of 121 landfill sites and total installed capacity of over 300MW. LFG is produced by decomposing organic matter in landfill sites. If released into the atmosphere unchecked, LFG contributes to pollution and is a potent greenhouse gas. By extracting LFG from landfill sites, Infinis fulfils an essential role in helping landfill operators meet their environmental compliance obligations. By using the collected LFG to generate electricity, Infinis supplies distribution networks with a consistent source of baseload power.

Sustainability

Infinis is now a diversified, renewable and low carbon energy generation business. It is developing over 1GW of new low carbon energy projects, including solar energy parks. Its continued investment in renewable energy is helping the UK reduce its reliance on fossil fuels and supports the UK’s energy sector transition to net zero. It also reduces electricity costs for consumers. Infinis' broader sustainability strategy revolves around creating value for its stakeholders, through protecting health, wellbeing and safety, reducing carbon emissions, eliminating exploitative work and improving diversity and inclusion. In 2022 the UK National Audit Office identified its Annual Report as best practice in relation to the Stakeholder engagement reporting.

Key facts>150 operational sites442MW of installed capacity257,000 tonnes of captured methane in FY22 -

Ionisos

FranceSocial infrastructure

Demographic change

Overview

Ionisos is a leading owner and operator of cold sterilisation facilities servicing the medical, pharmaceutical and cosmetics industries. Established in 1993 in Civrieux, France, Ionisos is the third largest cold sterilisation provider globally and operates a network of 10 facilities in Europe with market leading positions in France and Spain. It has over 200 employees and a highly diversified customer base of more than 1,000 customers.

Ionisos delivers a mission-critical, non-discretionary service for the medical, pharmaceutical and cosmetics industries for whom cold sterilisation is an essential component of the manufacturing process. It is typically applied to single use products that would be damaged by the heat and/or humidity of hot sterilisation methods.

Recent developments

Performance at Ionisos continues to be strong, with EBITDA growth exceeding expectations on the back of continuous strong demand in the medical and pharmaceutical markets, more than offsetting a downturn in the German cable industry. Inflation also remains a positive tailwind.

In order to meet this fast-growing demand, Ionisos has made good progress on a number of growth projects. It acquired a facility in Switzerland from an industrial company, it started operations of a new plant in Kleve, Germany, in January 2023 (on budget and with additional customers beyond the anchor client), and it is actively considering further greenfield expansion plans in both new and existing locations.

Investment rationale

3i Infrastructure acquired Ionisos in September 2019, having committed to invest in July 2019.

- Diversification of 3i Infrastructure’s sector exposure and increased presence in the French market

- Sound market fundamentals with non-cyclical drivers, including an ageing population in Western Europe

- Growing demand for healthcare services increasingly relying on single use medical equipment

- Increasingly stringent regulation governing the sterilisation of medical, pharmaceutical and cosmetics products

- High barriers to entry

- Platform potential with growth opportunities organically and through M&A

Sustainability

Ionisos supports public health by providing essential services to the medical and pharmaceutical industries through cold sterilisation. This ensures medical devices are safe for all to use. In 2022, 65% of revenues were derived from services provided to the medical and pharmaceutical industries. As part of its sustainability strategy, Ionisos is also working on GHG emission reduction initiatives, notably with implementation of fugitive emissions isolation measures, the deployment of solar panels in its Spanish facility and the conversion to electric of its duty vehicles fleet in France.

Key facts10 facilities across four countries in Europe> 200 employees>1000 customers Diversified customer base of more than 1,000 customersDeal teamView bioStéphane Grandguillaume

Partner

France / InfrastructureView bioPhil White

Vice Chair of Infrastructure

UK / InfrastructureView bioAntoine Matton

Director

France / InfrastructureView bioAdrien Delmotte

Director

UK / InfrastructureView bioMarco Pampanin

Analyst

France / Infrastructure -

Joulz

BeneluxEnergy

Energy transition

Overview

Joulz is a leading owner and provider of essential energy infrastructure equipment and services in the Netherlands. Joulz serves approximately 20,000 industrial, commercial, and public sector clients with its solutions, that encompass realization, maintenance, management, and leasing of energy infrastructure equipment.

Joulz’ service offering includes mid-voltage infrastructure (owning and leasing transformers, switchgear and cables under long-term contracts), storage (owning and leasing large scale battery storage systems under mid- to long-term contracts), solar (large-scale installations under operational lease or with government-subsidized PPAs), metering (owning and leasing 50,000 electricity and gas meters under mid-term contracts) and EV charging (AC and DC charge points in mid-term exploitation, rental or CPO contracts). Additionally, it provides integrated solutions to address energy transition challenges such as grid congestion.

Recent developments

Joulz performed ahead of expectations in the year, with the Infrastructure Services business unit continuing to see strong market demand. In December 2022, the business raised further debt financing on attractive terms to replenish its revolving credit facility, which is used to fund growth capex.

During the year, as part of a planned transition, Sytse Zuidema was recruited as CEO. Sytse is an engineer by background and has experience successfully leading several fast-growing businesses.

Investment Rationale

3i Infrastructure acquired Joulz in April 2019, having committed to invest in March 2019.

- Strong established asset base as well as good potential for growth

- Joulz is set to benefit from the Dutch government’s commitment to decarbonise the economy (the ‘Energy Transition’)

- The Energy Transition is expected to increase electricity consumption and demand for Joulz’s equipment and services

- 3i Infrastructure has relevant experience from investing in the Netherlands and previous investments in the electricity and leasing sectors

Sustainability

Sustainability is a key driver of Joulz’s business strategy. The company supports the electrification of the Dutch economy via the provision of medium-voltage electrical infrastructure, meters, solar PV, EV chargers, and energy storage - often multiple products are provided together as integrated energy transition solutions to solve key customer issues, such as grid congestion. The business itself generates a de minimis level of operational emissions, and in 2022 Joulz decided to only use SF6-free transformers for new installations.

Key factsOperates c.53,000 metering assets and c.7,000 transformersc.240 employeesc.20,000 customers -

Oystercatcher

SingaporeTransport & logistics

Upgrading ageing infrastructure

Overview

Oystercatcher is the holding company through which the Company holds a 45% interest in Advario Singapore Limited (previously Oiltanking Singapore Limited).

Advario Singapore is a 1.3 million cubic metre facility focused on storage and blending of refined clear petroleum products for a range of blue chip customers. With a premier location, on Jurong Island, it is accessed by pipeline, sea going vessel and barge.

Oiltanking is one of the world’s leading independent storage partners for oils, chemicals and gases, operating 41 terminals in 18 countries with a total storage capacity of 16 million cubic metres.

Recent developments

Performance at Advario Singapore in the period was in line with expectations. The market for oil products continues to be backwardated, with future prices below current prices. However, strong activity levels resulted in high storage utilisation across the region which was supportive for good contract renewals in the period. Advario Singapore continues to be the premier gasoline blending terminal in Singapore and in the wider Asia Pacific region, and therefore commands good rates.

The strategic transition to some green fuel storage is progressing well. In 2022, a first agreement was signed with an anchor customer to start storing and blending sustainable aviation fuel (“SAF”). The project is on track and is expected to be operational later in 2023. We believe this gives Advario Singapore a first mover advantage for SAF related business. During the period, a further contract has been agreed with a second customer for storing sustainable marine fuel.

Sustainability

Advario Singapore is focused on supporting its customers in the energy industry to achieve their sustainability ambitions. In 2022/2023 ADS has invested in infrastructure to allow it to store and blend sustainable aviation fuel for a customer. This positions ADS as the first terminal in Singapore with SAF blending capabilities and supports the business’ ESG credentials.

-

SRL Traffic Systems

UKTransport & logistics

Overview

SRL, which is headquartered in Cheshire, is the market leading temporary traffic equipment (“TTE”) rental company in the UK. SRL’s product range includes temporary traffic lights, adaptive detection systems, pedestrian and cyclist systems, variable messaging systems, barriers and CCTV. SRL offers its customers a full-service rental solution, which includes the planning and design of traffic management systems, installation, maintenance and integration with existing systems, as well as direct sales of equipment assembled by SRL.

SRL’s market-leading reputation is supported by its network of 28 depots nationwide, providing a 24/7 365 day a year service on which customers rely for quick deployment and reactive maintenance work.

Recent developments

SRL has performed broadly as expected during the financial year. Traffic light rental revenues are growing strongly at c.15% per annum despite activity levels being held back by lower roadworks budgets in H2 2022, resulting in lower days on hire than forecasted. EBITDA growth in the period has been supported by SRL’s strong market position and ability to increase prices in line with inflation.

We are working closely with management to professionalise account management processes and optimise fleet utilisation and build. Progress has also been made to engage directly with the end-promoters of roadworks and beyond SRL’s traditional customer base of traffic management companies.

Investment rationale

3i Infrastructure acquired SRL in December 2021.

- TTE is mission-critical to the safe use of roads

- SRL fits with the Company’s strategy of investing in companies with leading market positions and barriers to entry, yet with operational levers to achieve attractive returns for shareholders through active asset management

- SRL has sound market fundamentals through the increasing emphasis placed on health and safety, and a growing propensity to rent rather than own TTE

- Outsourcing ownership of TTE makes economic sense for traffic management companies, as it allows them to more efficiently manage maintenance and utilisation

- SRL has a market leading reputation and is trusted by its customers

Sustainability

SRL's temporary traffic solutions enable greater segregation and control of traffic flows, in turn improving safety and reducing congestion around roadworks. On a congested junction, SRL’s adaptive detection system can reduce the average journey time by up to 22%. This improves satisfaction for road users and local communities, and reduces pollution. In addition focus is being placed on health and safety through the use of more sophisticated methods of traffic management to protect highway workers and segregate traffic, cyclists and pedestrians.

Key facts30 strategically located depots in the UKc.13,000 pieces of equipment under full service contracts24/7 service with access to any location within two hours -

Tampnet

NorwayCommunications

Digitalisation

Overview

Tampnet is the leading independent offshore communications network operator in the North Sea and the Gulf of Mexico. It is headquartered in Norway, with operations in the UK, Scandinavia and the USA.

Tampnet provides high speed, low latency and resilient data connectivity offshore through an established and comprehensive network of fibre optic cables, 4G base stations, and microwave links. It operates across four main business areas: fixed installations, mobile rigs and vessels, roaming for offshore workers and international carriers. The majority of its business involves providing fixed fibre links to oil platforms.

Recent developments

Tampnet has performed well in the year, exceeding budgeted revenue and EBITDA targets thanks to increased offshore activity on the back of improved sentiment in the O&G markets, stronger demand for bandwidth upgrades and an increased focus on energy security by governments in Europe and the US.

Tampnet is marking good progress on growth projects across the business, including new platform connections in the Gulf of Mexico and the North Sea and in the offshore wind segment. The management is also in discussions with several carbon capture and storage projects in the North Sea which are all located within Tampnet’s existing network.

The Digitisation proposition offered by Tampnet (combining low latency connectivity with services such as Private Networks) is continuing to prove very popular with customers. The management team are confident that they will see an acceleration of the short-term penetration of Digitisation projects.

Investment Rationale

3i Infrastructure acquired 50% of Tampnet in March 2019 alongside Danish pension fund ATP, having committed to invest in July 2018.

- Tampnet’s fibre optic links provide customers with mission-critical reliable communications

- Benefits from the growing requirement for high bandwidth and low latency in data networks

- More than 50 customers including oil and gas operators, offshore service providers and telecom operators

- Opportunity to grow into new segments such as offshore wind, commercial vessels and the point-to-point carrier segment

Sustainability

Tampnet provides digital connectivity for remote customers such as oil and gas platforms, which supports energy security. Tampnet also increasingly provides services in the offshore wind segment which supports the Energy Transition, and is actively targeting the carbon capture and storage sector. To address the low female representation in its sector, the company has launched a “Women in Tech” programme dedicated to attracting female employees, and has public targets to improve the representation of female employees across its business and in management by 2025.

Key facts1,200km offshore cable system acquired in 2020>50 customers in multiple sectorsWorld’s largest offshore high-capacity communication network -

TCR

BeneluxTransport & logistics

Upgrading ageing infrastructure, Energy transition

Overview

Headquartered in Brussels, Belgium, TCR is Europe’s largest independent asset manager of airport ground support equipment (“GSE”) and operates at more than 180 airports.

Since inception, TCR has defined the market for leased GSE, providing high quality assets and a full service leasing, maintenance and fleet management offering to its clients, which are predominantly independent ground handling companies, airlines and airports. This enables GSE operators to concentrate on their core business of ground handling. The GSE that TCR provides is critical infrastructure, without which some of Europe’s busiest airports could not operate.

Aerolima acquisition

In 2019, TCR acquired Aerolima, another lessor of GSE in France. The transaction added approximately 2,000 pieces of equipment, 20 airports and 12 workshops to TCR’s existing business.

Recent developments

Over the last 12 months, TCR’s activity increased significantly, materially surpassing pre-Covid levels. This outperformance reflects a sustained rebound of air traffic as well as an increased post-pandemic demand for full-rental GSE solutions globally: TCR added over 35 airports in 2022 and its off-lease rate has reverted to early 2019 levels.

Last November, following a bilateral process, TCR completed the acquisition of Adaptalift, a provider of GSE and associated maintenance services to the aviation industry across Australia, adding incremental EBITDA at an attractive valuation with strong expected synergies.

In parallel, TCR has signed important new contracts with flagship customers, which may lead to further sale-and-lease-back opportunities.

To support this strong growth, TCR successfully completed the refinancing of its existing RCF in January, raising €225 million of new debt facilities.

Investment rationale

TCR fits with the Company’s strategy of investing in companies with good asset backing, strong market positions and barriers to entry, yet with operational levers to achieve attractive returns for shareholders through active asset management:

- GSE is a scarce resource that is critical to the functioning of an airport; through first mover advantage, TCR has benefited from securing the largest independent GSE fleet in Europe. TCR has access to maintenance workshops in prime locations at airports, many of which are located airside. This means that a high quality maintenance and asset management service can be provided, resulting in high availability of TCR’s fleet.

- TCR is able to offer full-service rentals on a pan-European basis. This creates competitive advantages against competitors, which tend to offer either dry leases or only repair and maintenance services. TCR’s network means it can offer pan-European solutions at multiple locations, matching the footprints of its customers.

- Outsourcing ownership of GSE equipment makes economic sense for independent ground handlers, as it allows them to manage the mismatch between short-term handling contracts and the typically 10-15 year useful life of equipment.

- TCR’s rental contracts are aligned with the ground handlers’ contracts with the airlines and are typically 3-5 years in duration. TCR has experienced a high level of contract renewal.

- The business has a diversified portfolio and is present at over 180 airports across 18 countries with a diverse contract and customer base meaning the revenues of the business are not materially reliant on a single client or geography.

- The investment will provide exposure to the long-term growth in the aviation market, which is fundamentally GDP driven, yet it is expected to be insulated from short-term shocks to demand due to its exposure to aircraft movements rather than passenger numbers.

Sustainability

TCR has developed a sustainability strategy that aims to reduce the business' impact on the environment through supporting airports, airlines and handlers in reducing their GHG emissions. TCR encourages its customers to use greener equipment, and uses smart technology to enable customers to require less equipment. TCR is also a global business with a workforce comprising over 56 nationalities and speaking over 48 languages. The business supports inclusion through a number of initiatives such as free English lessons where required.

Key facts>180 airports Operates at over 180 airports>1,200 employeesc.35,000 ground support equipment assets -

Valorem

FranceEnergy

Energy transition

Overview

Valorem is a leading independent renewable energy development and operating company. It is one of the largest onshore wind developers in France, having developed over 600MW of capacity over the last 10 years.

The French power market is experiencing a major transition as it looks to reduce its reliance on nuclear generation and to increase generation from renewable sources of energy such as wind and solar. The energy transition has been continuously supported by the French governments over the past decade. With in-house capabilities across the entire project cycle and a strong local footprint, Valorem is well positioned to benefit from this shift in energy mix.

Recent developments

It has been a very strong year for Valorem, with significant EBITDA growth and an increase in total closed capacity of 270MW, to 778MW. The short-term negative impact of the energy windfall tax introduced by the French Government was partially offset by increased auction tariffs. Longer term, market fundamentals remain strong given the ongoing issues with nuclear power plants in the country. The pipeline of wind and solar projects continues to grow as expected.

Internationally, the construction of the Viiatti windfarm (313MW) is progressing to plan, with completion expected in 2024. The broader pipeline in Finland continues to mature well. In Greece, Valorem financed its first wind project during the period and is progressing well on further wind and solar opportunities.

Beyond its core business, Valorem is exploring further growth initiatives in the floating off-shore wind segment, making progress on its first green hydrogen project and the development of a battery storage pipeline.

Regulatory and political environment

Renewables benefit from strong support from the French Government, which has an objective of a 32% renewables contribution by 2032 coupled with a carbonneutral electricity mix by 2040. In line with the need to triple the current installed PV capacity by 2023, in December 2017 the Government announced an increase of future PV auctions from 1.45GW to 2.45GW per annum over the next three years.

Investment rationale

This investment diversifies the Company’s portfolio with exposure to a growing renewables business in one of the most attractive European markets, and access to recurring, inflation-linked cash flows underpinned by a robust regulatory regime.

Led by its experienced management team, Valorem is a best-in-class developer, being the fourth largest French wind developer and the largest independent one. It has a significant pipeline of projects at an advanced stage of development that it expects to convert into operating assets, with further projects at earlier stages to bring through the development process.

Sustainability

Valorem has grown its owned operational renewable assets base from 157MW at acquisition in 2016, to 508MW in 2022, with a further 270MW owned capacity under construction. This includes onshore wind, solar and hydro-electric generation. The business is also making headway into battery storage, green hydrogen and floating offshore wind. Valorem is a mission-driven company that aims to support local and inclusive economic growth and job creation, with a particular focus on inclusion. In 2022, 12% of working hours on Valorem’s solar construction sites were reserved to the long-term unemployed.

Key facts910MW of wind, solar and hydro assets operated, plus a pipeline of over 5GW owned390 employees503MW of fully developed renewable capacity owned, plus a further 205MW under construction