-

ESVAGT

DenmarkEnergy

Overview

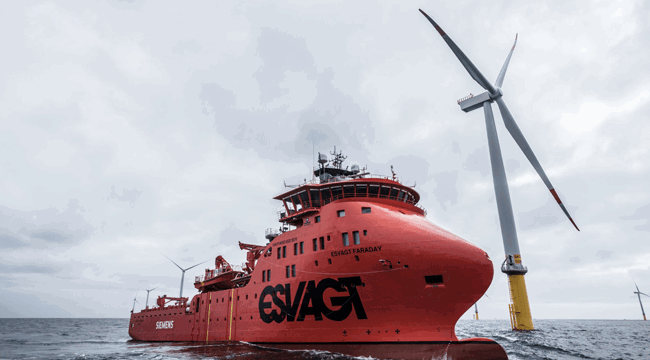

Headquartered in Esbjerg, Denmark, ESVAGT is the market leader in the fast-growing segment of service operation vessels (“SOV”) for the global offshore wind industry. The Company is also a leading provider of emergency rescue and response vessels (“ERRV”) and related services to the offshore energy industry in and around the North Sea and the Barents Sea.

ESVAGT is the pioneer and market leader in the provision of SOVs to offshore wind farms, with nine bespoke vessels in operation and a further four under construction. SOVs are purpose-built, high performance vessels, providing efficient transport of maintenance technicians to wind turbines and other offshore wind equipment, under long term contracts. The offshore wind market, and hence demand for SOVs, is expected to grow strongly over the coming years, creating significant opportunities for the company.

Its ERRV services mainly involve the rescue and recovery of personnel, but also include the dispersion and recovery of oil spills, crew transfers and towing. ESVAGT is the leading provider of ERRV services in Denmark and Norway, with market shares of approximately 100% and 50%, respectively, as well as an established and growing presence in the UK. The majority of ESVAGT’s ERRV revenues are associated with North Sea oil and gas production support, with the remainder generated by supporting exploration activity.

ESVAGT has been operating since 1981, employs over 1,200 people and owns a fleet of more than 40 vessels.

Recent developments

ESVAGT performed in line with expectations during the year.

ESVAGT is the market leader in European offshore wind Service Operation Vessel (‘SOV’) provision, currently operating nine vessels, with an additional four SOVs under construction - three in Europe and one in the US. These vessels are specifically designed to serve long-term charter agreements.

The European offshore wind development pipeline continues to see significant growth, driven by increasing government targets for offshore wind and a heightened focus on energy security. In contrast, the US market is facing uncertainty due to a pause in new offshore wind projects. ESVAGT has also established a joint venture with KMC Line in South Korea, which, if successful, could see ESVAGT becoming the first international SOV operator in the South Korean market, adding an alternative growth market to the business.

ESVAGT’s Emergency Response and Rescue Vessel (‘ERRV’) segment performed strongly, with high day rates and utilisation levels. The ERRV market remains attractive, supported by stable demand and a shrinking supply of available ERRVs to that market, due to vessel attrition and limited new tonnage entering the market.During the year, ESVAGT closed a further €200 million committed debt facility at attractive rates, providing additional capital to support its growth plans.

Investment rationale

3i Infrastructure acquired ESVAGT from AP Møller-Maersk and other minority shareholders in September 2015, in a consortium with AMP Capital.

ESVAGT has strong infrastructure characteristics and operates in an attractive market:

- It is a market leader in Denmark and Norway and has a small but growing presence in the UK offshore oil and gas market and in the expanding North Sea offshore wind sector.

- It is an asset intensive business, with a modern state-of-the-art fleet of purpose-built vessels.

- A high proportion of its revenues is contracted over the medium term with a diverse customer base featuring limited customer concentration, underpinning stable and predictable cash flows.

- It provides an essential service for the offshore energy industry in light of regulatory health and safety requirements, which constitutes a small component of the overall production cost, resulting in lower price sensitivity;

- It operates in a market with high barriers to entry, as customers require bespoke vessels, manned by experienced crews with a strong safety track record. The harsh weather conditions and language barriers also inhibit new market entrants based outside the region; and

- With its leading market position, strong safety track record and state-of-the-art fleet, ESVAGT is optimally positioned to exploit growth opportunities in the UK and potentially further afield, as well as in the offshore wind energy market.

Sustainability

ESVAGT now has over 60% of its contracted EBITDA serving the Wind sector, up from 25% at the time of acquisition. ESVAGT’s US joint venture, CREST, co-owned with Crowley, won its first contract in the US offshore wind market in early 2023 for Siemens Gamesa. In FY24, ESVAGT won two additional SOV contracts with Ørsted and Vestas in the North Sea. ESVAGT also signed a Memorandum of Understanding with KMC Line, a Korean shipping company, to establish a joint venture in South Korea and enter the South Korean wind market.

Deal teamOscar Tylegård

Partner

UK / InfrastructureClaudio Ossanna

Senior Associate

UK / InfrastructureAnna Dellis

Partner

UK / InfrastructureAlexi Kirilenko

Director

UK / Infrastructure