Our business model

Characteristics we look for in new investments

We look to build and maintain a diversified portfolio of assets, across a range of geographies and sectors, whilst adhering to a set of core investment characteristics and risk factors.

The Investment Manager has a rigorous process for identifying, screening and selecting investments to pursue. We look for businesses that combine a base of strong cash flow resilience (for example, contracted revenues) with high through-cycle underlying market growth fundamentals and operational improvements, and M&A opportunities, which allows us to deliver above target returns. Although investments may be made into a range of sectors, the Investment Manager typically focuses on identifying investments that meet most or all of the following criteria and are aligned with identified megatrends:

Owning or having exclusive access under longterm contracts to assets that are essential to deliver the service.

Assets that require time and significant capital or technical expertise to develop, with low risk of technological disruption.

Services that are an integral part of a customer’s business or operating requirements, or are essential to everyday life

Businesses that have a long-standing position, reputation and relationship with their customers – leading to high renewal and retention rates.

Long-term contracts or sustainable demand that allow us to forecast future performance with a reasonable degree of confidence.

Businesses that have downside protection, but the opportunity for outperformance.

Opportunities to grow or to develop the business into new markets, either organically or through targeted M&A.

Businesses that meet or are committed to meeting the criteria set out in our Responsible Investment policy and will work with us to enhance their ESG maturity.

Our business model creates long-term value for stakeholders

Enablers

The Company is managed by an experienced and well-resourced team. The European infrastructure team was established by 3i Group plc in 2005.

3i Group has a network of offices, advisers and business relationships across Europe. The Investment Management team leverages this network to identify, access and assess opportunities to invest in businesses.

We build close partnerships with our portfolio companies’ management teams to develop and execute a strategy to create long-term value in a sustainable way. Examples include developing strategies, improving operational performance and establishing governance models that promote alignment between management and stakeholders.

We have built a strong reputation and track record as investors by investing and managing our business and portfolio companies responsibly and by carrying out activities to high standards of conduct and behaviour. 3i has earned the trust of shareholders, other investors and investee companies, which the Board seeks to maintain through transparent corporate reporting and clear and open dialogue with stakeholders.

Our dedicated ESG team enables us to identify, monitor and realise the value-creation opportunities linked to sustainability for relevant portfolio companies more effectively. The team supports each portfolio company to enhance their ESG maturity.

Established investment and asset management processes are supported by the Investment Manager’s comprehensive set of best practice policies, including governance, conduct and anti-bribery.

The Company’s flexible funding model seeks to maintain an efficient balance sheet with sufficient liquidity to make new investments or support portfolio companies. Since FY15 the Company has raised equity three times and returned capital to shareholders twice following successful realisations.

How to create value

Buy well

Effective use of 3i's network

Comprehensive due diligence

Consistent with return/yield targets

Fits risk appetite

Strong governance

Make immediate improvements

Board representation

Appropriate Board composition

Incentivise and align management

Optimise strategy

Agree strategic direction

Develop action plan

Right capital structure to fund growth plan

Enhance ESG maturity

Execute plan

Ongoing support

Monitor performance

Review further investment opportunities

Facilitate and execute M&A

Realisation

Position business and enhance infrastructure characteristics to maximise exit value

Long-term view but will sell to maximise shareholder value

How we create value

Value created

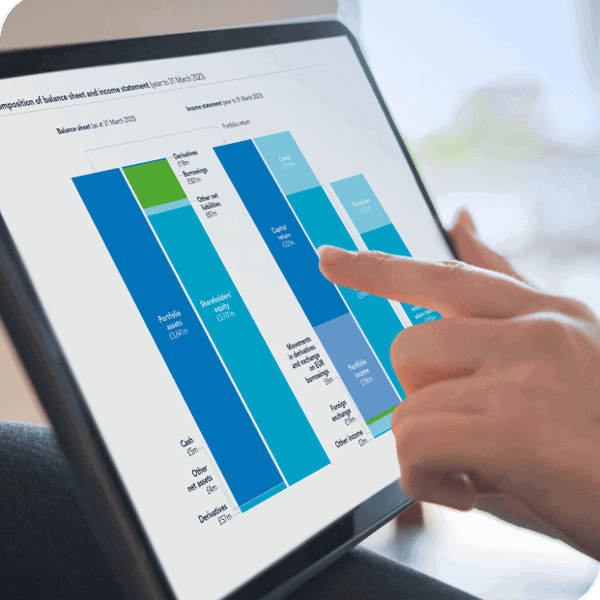

Financial

11.4 %

Total return on opening NAV

11.90 p

Ordinary dividend per share

18 %

Asset IRR (since inception)

Non-financial

5

Further investments in existing portfolio companies to fund growth

+ 17 %

Increase in installed renewable energy

100 %

Portfolio companies reporting on GHG emission