Key performance indicators

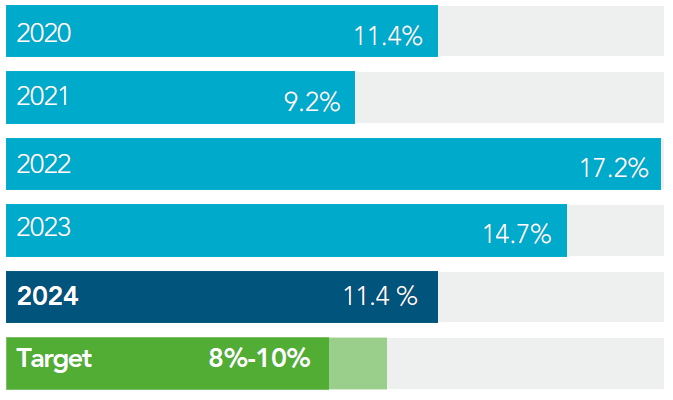

Total return (% on opening NAV)

Target

To provide shareholders with a total return of 8% to 10% per annum, to be achieved over the medium term.

Outcome for the year

Total return of 11.4% for the year to 31 March 2024.

Performance against target

Met or exceeded target for 2024 and every prior year shown.

Rationale, definition and performance over the year

Rationale and definition

- Total return is how we measure the overall financial performance of the Company

- Total return comprises the investment return from the portfolio and income from any cash balances, net of management and performance fees and operating and finance costs. It also includes foreign exchange movement and movement in the fair value of derivatives and taxes

- Total return, measured as a percentage, is calculated against the opening NAV, net of the final dividend for the previous year, and adjusted (on a time-weighted average basis) to take into account any equity issued and capital returned in the year

Performance over the year

- Total return of £347 million in the year, or 11.4% on opening NAV

- The portfolio showed good resilience overall with strong performance in particular from TCR, Tampnet and Valorem, and the return generated from the sale of Attero

- The performance of DNS:NET detracted from the portfolio return

- The hedging programme continues to reduce the volatility in NAV from exchange rate movements

- Costs were managed in line with expectations

As at 31 March 2024

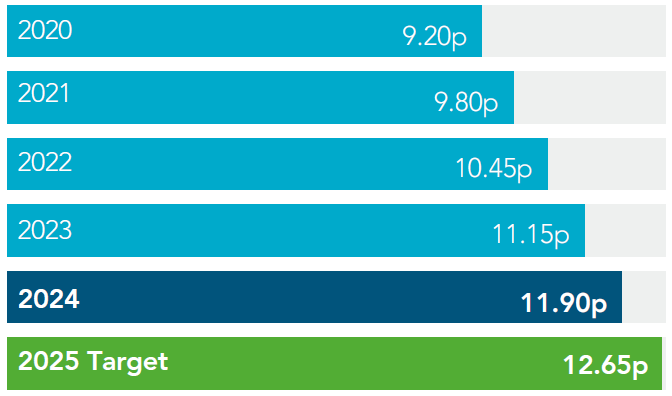

Annual distribution

pence per share

Target

Progressive dividend per share policy. FY25 dividend target of 12.65 pence per share.

Outcome for the year

Total dividend of 11.90 pence per share paid and proposed.

Performance against target

Dividend per share increased every year since IPO.

Rationale, definition and performance over the year

Rationale and definition

- This measure reflects the dividends distributed to shareholders each year

- The Company’s business model is to generate returns from portfolio income and capital returns (through value growth and realised capital profits). Income, other portfolio company cash distributions and realised capital profits generated are used to meet the operating costs of the Company and to make distributions to shareholders

- The dividend is measured on a pence per share basis, and is targeted to be progressive

Performance over the year

- Proposed total dividend of 11.90 pence per share, or £110 million, is in line with the target set at the beginning of the year

- Income generated from the portfolio and cash deposits, including non-income cash distributions and other income from portfolio companies, totalled £208 million for the year

- Operating costs and finance costs used to assess dividend coverage totalled £88 million in the year

- The dividend was fully covered for the year

- Setting a total dividend target for FY25 of 12.65 pence per share, 6.3% higher than for FY24

As at 31 March 2024