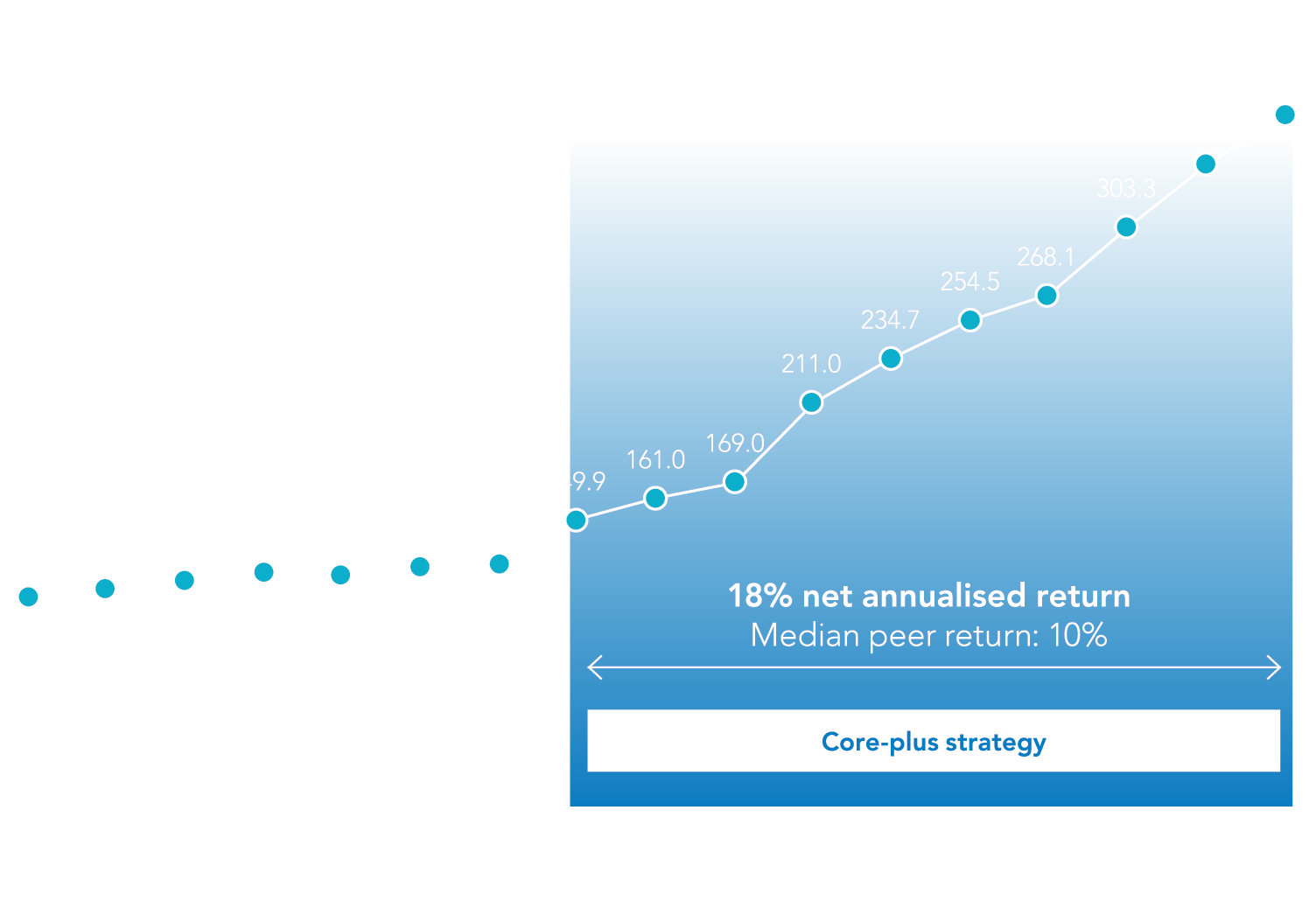

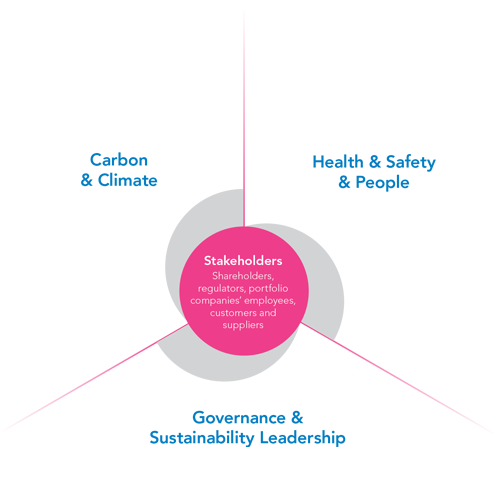

Our purpose is to invest responsibly in infrastructure, delivering long-term sustainable returns to shareholders and having a positive influence on our portfolio companies and their stakeholders.

Hear more about what this means

Scott Moseley and Bernardo Sottomayor, Managing Partners and Co-Heads of European Infrastructure 3i Investments plc