What we need to create value

3i Infrastructure relies on the expertise of the Investment Manager to source, execute and manage investments, by using its extensive network.

Investment Manager's team

The Company is managed by an experienced and well-resourced team. The European infrastructure team was established by 3i Group in 2005.

The partners in the Investment Management team have a combined infrastructure investment experience of 114 years and have been at 3i for a combined 86 years.

We have a very experienced group of infrastructure investment professionals, supported by dedicated finance, tax, legal, operations, ESG and strategy teams.

3i Group's network

3i Group has a network of offices, advisers and business relationships across Europe. The Investment Management team leverages this network to identify, access and assess opportunities to invest in businesses, on a bilateral basis where possible, and to position the Company favourably in auction processes.

Engaged asset management

We create value from our investments through the Investment Manager’s engaged asset management approach. Through this approach, the Investment Manager partners with our portfolio companies' management teams to develop and execute a strategy to create long-term sustainable value.

Examples of this partnership include: developing strategies that support investment in the portfolio company’s asset base over the long term; continued improvements in operational performance; and establishing governance models that promote an alignment of interests between management and stakeholders.

We develop and supplement management teams, often bringing in a non-executive chair early in our ownership.

View examples of this engaged asset management approach.

Reputation and brand

The Investment Manager and the Company have built a strong reputation and track record as investors by investing and managing their business and portfolio responsibly and by carrying out their activities according to high standards of conduct and behaviour. This has been achieved through upholding the highest standards of governance, at the Investment Manager, the Company, and in portfolio companies. This in turn has earned the trust of shareholders, other investors and portfolio companies, and has enabled the Investment Manager to recruit and develop employees who share those values and ambitions for the future.

The Board seeks to maintain this strong reputation through a transparent approach to corporate reporting, including on our progress on driving sustainability through our operations and portfolio. We are committed to communicating in a clear, open and comprehensive manner and to maintaining an open dialogue with stakeholders.

| Integrity | The Board acts with honesty, dedication and consistency, with the courage to do the right thing in every situation. The Board manages its relationships based on trust and respect. |

| Objectivity | The Board applies a fair, transparent and balanced approach to decision making. The Board values diversity of opinion and encourages different perspectives to bring constructive challenge as it discharges its responsibilities. |

| Accountability | The Board acts in the interest of all stakeholders of the Company, ensuring that obligations to shareholders are understood and met. |

| Legacy | The Board seeks to develop a company and portfolio that delivers long-term, sustainable value for our shareholders and society. |

Robust policies and procedures

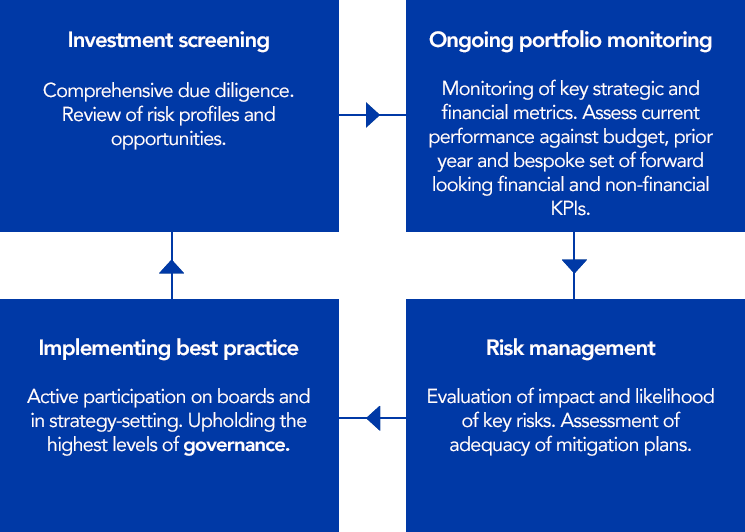

Established investment and asset management processes are supported by the Investment Manager's comprehensive set of best practice policies, including governance, conduct and anti-bribery.

Dedicated ESG team

In FY23, the Investment Manager created a new team to lead ESG and sustainability initiatives across the portfolio. The ESG team’s role is to ensure the Company’s approach is right for the portfolio and to drive genuine ambition and progress at portfolio company level.

Dedicated ESG resource enables us to identify, monitor and realise the value-creation opportunities linked to sustainability for relevant portfolio companies more effectively and to identify and manage sustainability risks.

The team supports each portfolio company in enhancing its ESG maturity, in line with the sustainability pathway described on page 45 of our annual report. The team also leads ESG reporting for the Company and delivers the annual ESG review of the portfolio.

The Investment Manager is committed to constructing and managing the Company’s portfolio in accordance with the Investment Manager’s Responsible Investment policy, which covers a range of ESG issues including climate.

Sustainability and ESG standards are discussed throughout our Annual Report, including in the Sustainability section on pages 44 to 51 and the Risk report on pages 63 to 74.

"There is a strong link between companies that have high ESG standards and those that are able to achieve long-term sustainable business growth."

Anna Dellis, Partner

Efficient balance sheet

The Company’s flexible funding model seeks to maintain an efficient balance sheet with sufficient liquidity to make new investments or support portfolio companies.

Since FY15 the Company has raised equity three times and returned capital to shareholders twice following successful realisations.